capital gains tax news 2020

Passive income like capital gains and losses provides great examples of the potential impact of a tax plan. The tax rate on most net capital gain is no higher than 15 for most individuals.

What Is Capital Gains Tax And When Are You Exempt Thestreet

As background there are certain provisions in the Income Tax Law.

. Saudi Arabias General Authority of Zakat and Tax GAZT published on 15 June 2020 Circular No. The UKs Office for Tax Simplification has released a new report on overhauling the UKs CGT system. 2020 taxes capital gains tax home selling advice selling a home tax bill tax deductions updates Margaret Heidenry is a writer living in Brooklyn NY.

2020 Long-Term Capital Gains Tax Rate Income Thresholds The tax rate on short-term capitals gains ie from the sale of assets held for less than one year is the same as the rate you pay on wages and other ordinary income. 2005003 dated 31 May 2020 on capital gains tax CGT matters related to corporate reorganization or restructuring events. November 16 2021 from the kiplinger website if you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale isUnion Budget 202223 Indian Budget News Today from.

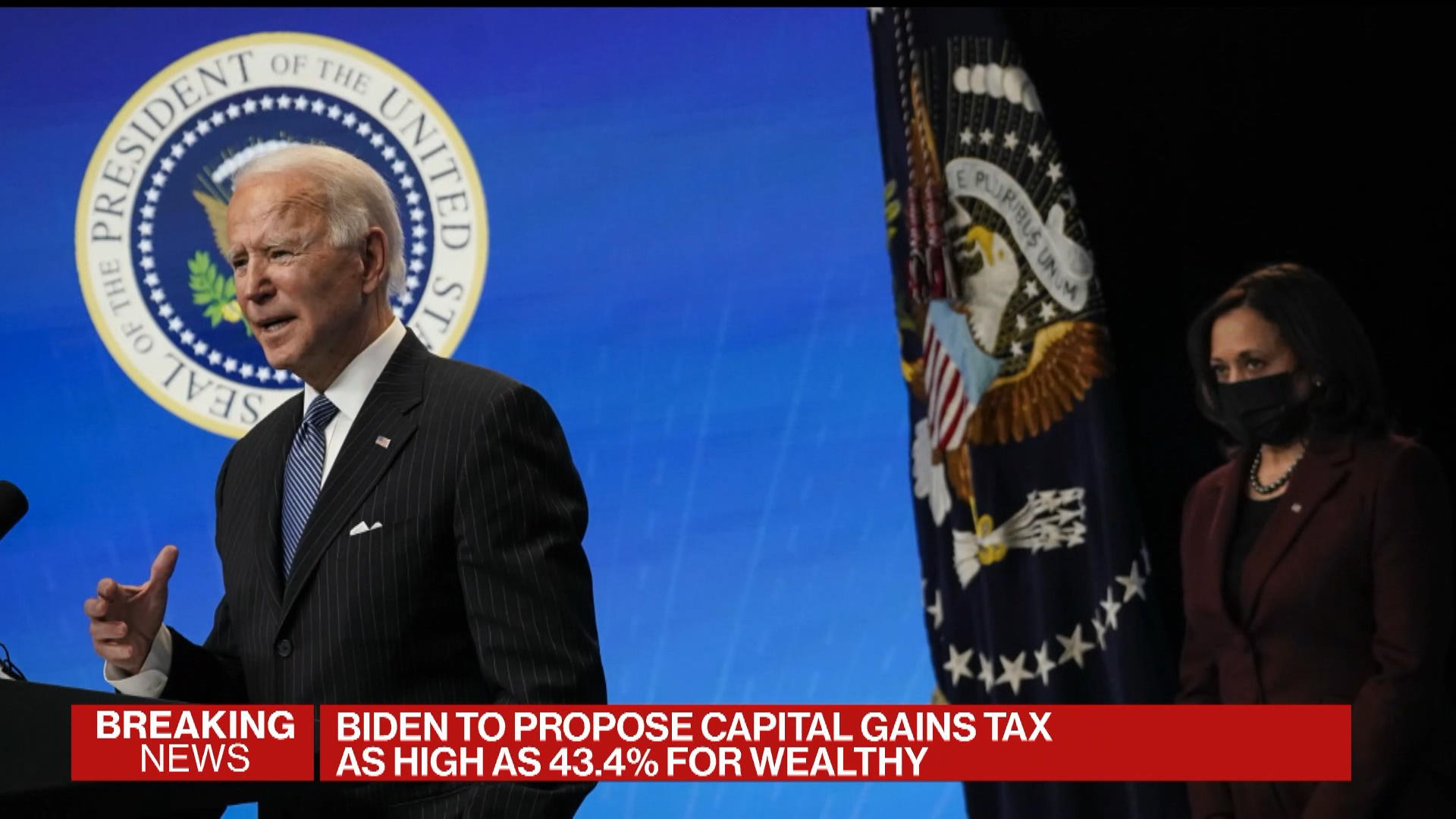

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. Bidens proposal would take the tax code. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to.

Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. Critics rally against Bidens capital gains tax proposal. Her work has appeared in the New York Times.

Capital gains tax rates on most assets held for less than a year correspond to. Under the income tax act gains from sale of capital assets both movable and immovable are subject to capital gains tax. The Lowdown on Capital Gains Tax Rates for 2020 and Beyond Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation.

HM Revenue Customs. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Special real estate exemptions for capital gains.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. More closely aligning UK capital gains tax CGT rates with income tax rates could raise significant revenues for the UK a government-commissioned review has concluded. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do.

Capital gains tax continued to be suspended until 2020. For single folks you can benefit from the zero percent capital gains rate if you have an income below 40000 in 2020. Where a property is disposed of on or after 6th April 2020 a CGT return and the tax payment must be made within 30 days of the completion date a much shorter notice period for the installment election.

The rules for the regime were set out in Prakas 346 in the Khmer language issued in September 2020. Short-term assets are taxed at ordinary income tax rates which can be as high as 37 in 2021 and 2022. The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widower. 17 November 2020. Assets that have been sold at a profit and have been held for one year or less are subject to short-term capital gains taxes.

2022 Capital Gains Tax Pages 2022 Capital Gains Tax Pages. Capital gains tax is effectively tax you pay on the profit youve made on your propertys appreciation since you bought it. The levy which was originally to be introduced from July 2020 was previously extended to January 1 2021 and again to January 1 2022.

Capital Gain Tax Rates. Additionally these assets can also receive an additional 38 Medicare surtax depending on the sellers income level. Most countries have more favorable treatment of long term capital gains than we do.

This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million. The FA 2021 has altered that exemption in a significant way. The above-mentioned 2020 changes will create a practical problem in giving notice before the tax becomes due.

Capital Gains Tax on Share Transfers. When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to. Collecting government electronic payments is mandatory for governmental agencies.

Saudi Arabian Tax Authority clarifies rules on capital gains. Due to the complexity of tax situations we dont guarantee these results. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay capital gains tax at 10.

Authorities in Cambodia have announced a further two-year delay to the implementation of a capital gains tax. Immediately prior to the amendment of the Capital Gains Tax Act CGTA by the FA 2021 capital gains accruing to a person whether a company or an individual from the disposal of shares were not chargeable to tax.

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

The Long And Short Of Capitals Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Capital Gains Tax On Sale Of Property I Tees Law

Long Term Capital Gains Tax Rates In 2020 The Motley Fool

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Reducing Capital Gains Tax When Selling Rental Property Unbiased Co Uk

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Capital Gains Tax On Separation Low Incomes Tax Reform Group

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax 10 Ways To Reduce How Much Tax You Need To Pay To Hmrc Personal Finance Finance Express Co Uk

2021 And 2022 Capital Gains Tax Rates Forbes Advisor